charitable gift annuity tax deduction

Charitable Gift Annuity. That might seem counterintuitive but a combination.

Charitable Gift Annuity National Gift Annuity Foundation

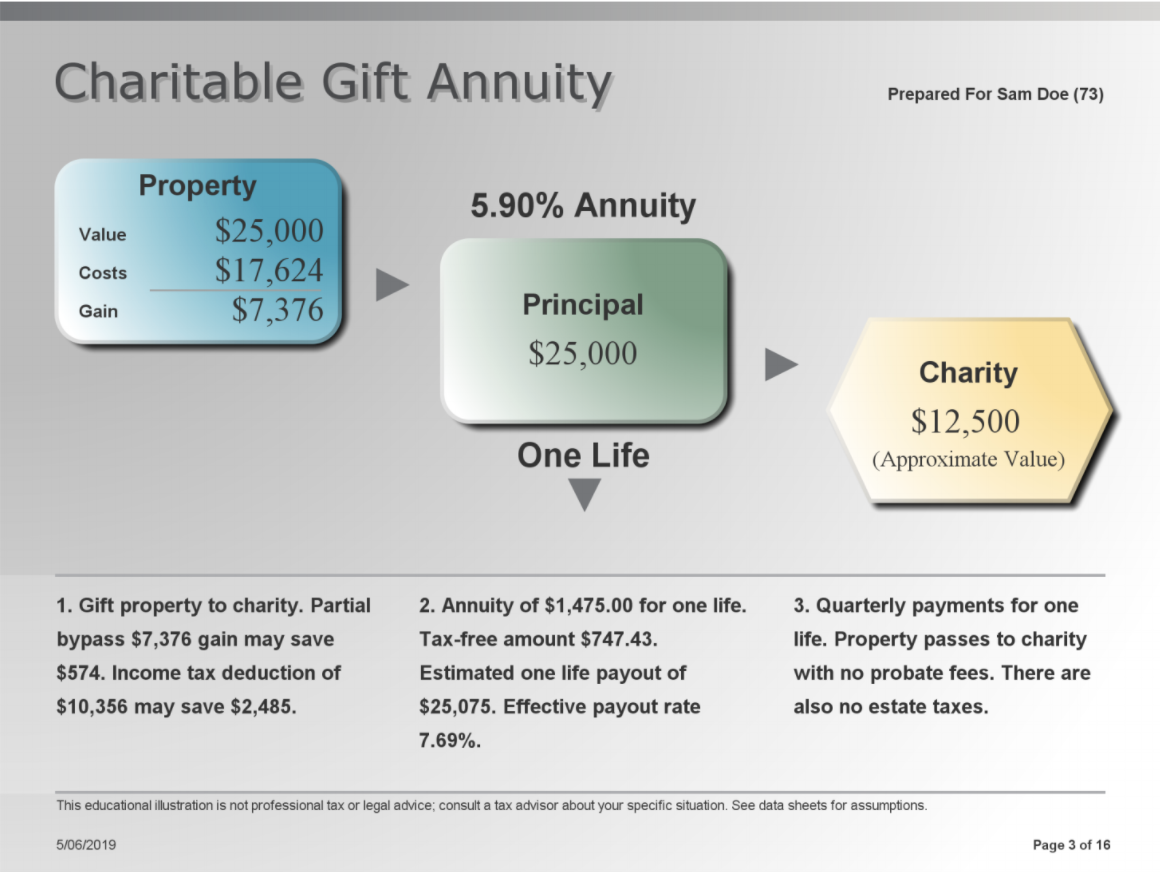

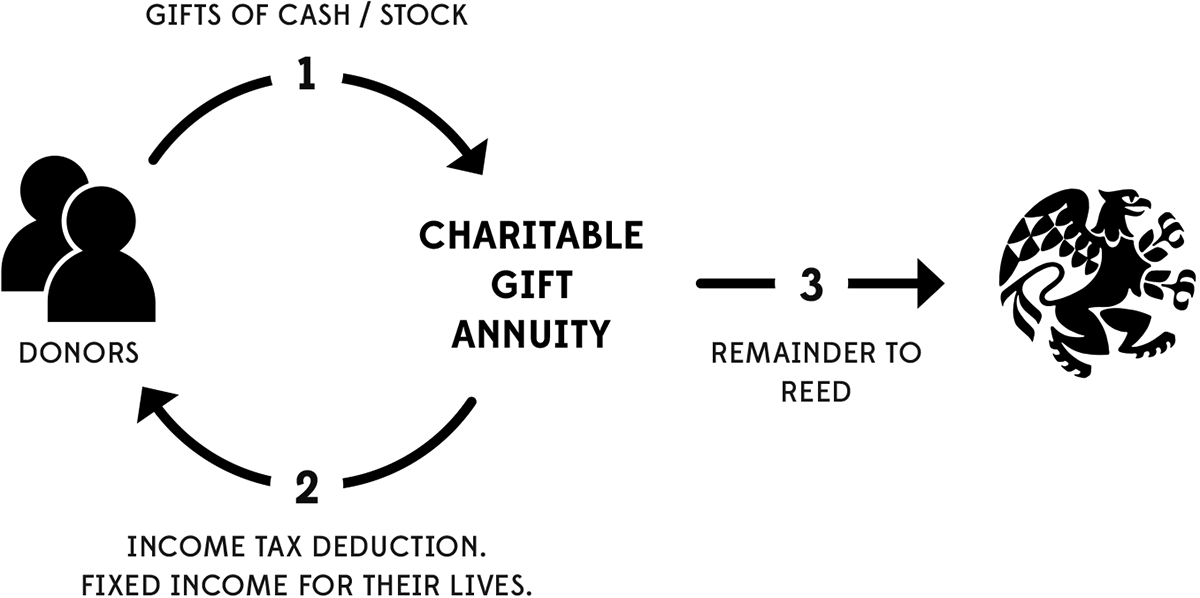

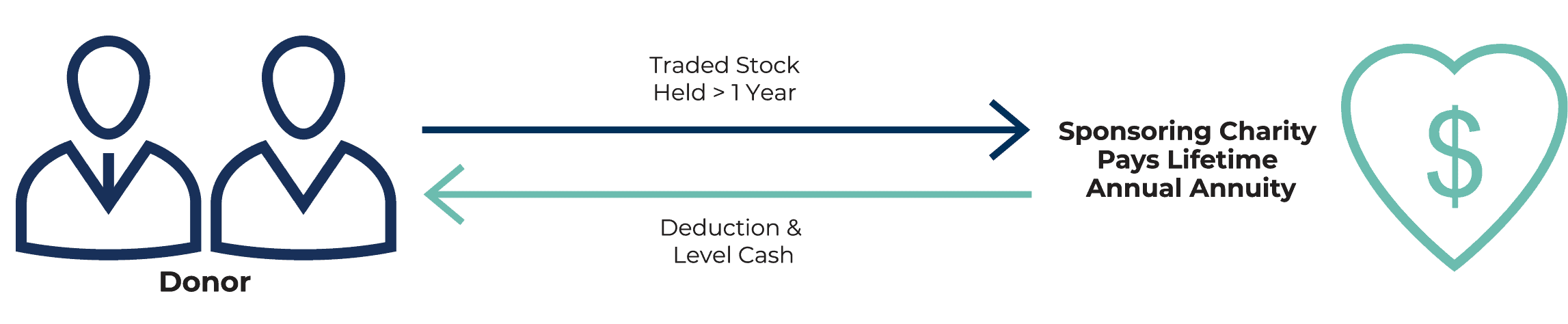

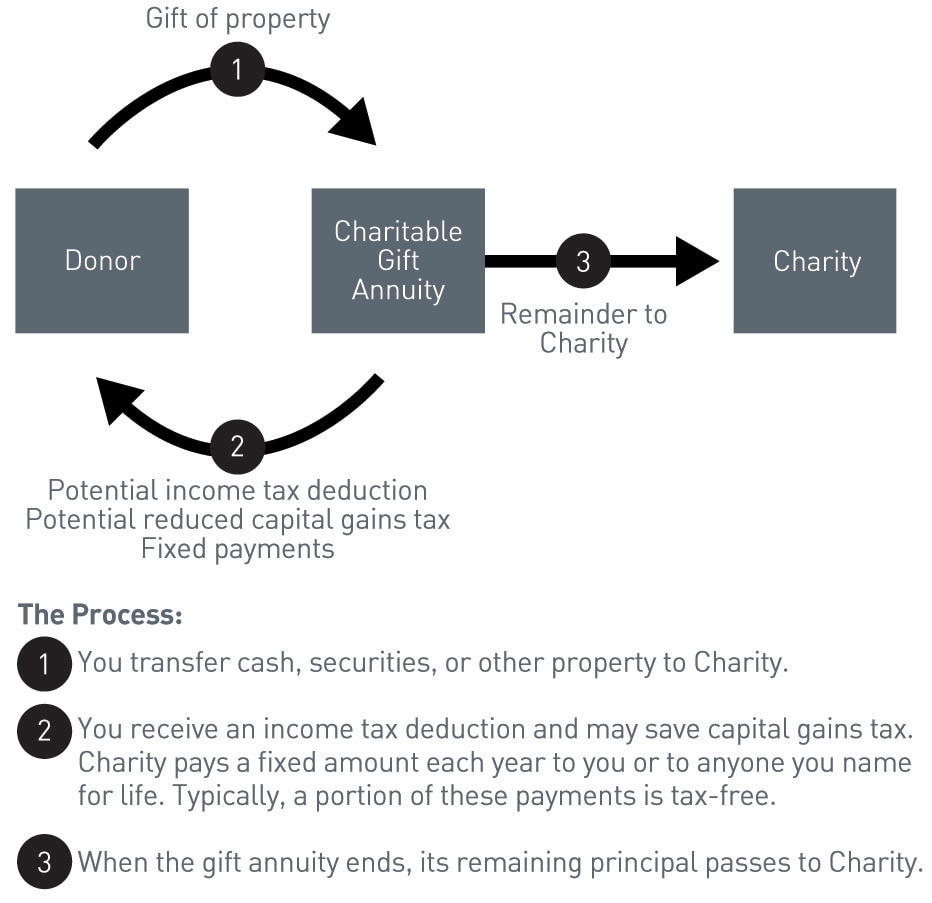

It is possible to fund a charitable gift annuity with cash securities or any other asset.

. As a donor you make a sizable gift to charity using cash securities or possibly other assets. That is a portion may. This calculation is usually done by the charitable.

With a charitable gift annuity a donor accepting a lower charitable deduction may mean more for the donor in tax savings. The annual tax-free portion of the 6800 is computed by dividing the cost of the annuity contract 53808 by her life expectancy. The IRS assumes the cost basis to be 0.

The deduction is calculated by taking the full gift amount and subtracting the present value of all the annuity payments. It will pay her 800000 a year or 40 a year for the rest of her life. Up to 25 cash back For 2013 the ACGA suggests that a 55-year-old be guaranteed a 4 annual return.

A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. When you create a charitable lead trust you can generally take a charitable income tax deduction equal to the present value of the payments to be made to charity. Although in most cases this would be much.

A type of gift transaction where an individual transfers assets to a charity in exchange for a tax benefit and a lifetime annuity. We use cookies to improve security personalize the user experience enhance our marketing activities including cooperating with. If a gift is made during the lifetime of the donor it qualifies for income-tax and gift-tax charitable deductions.

Butler who is 75 years old establishes a 25000 gift annuity for the eventual benefit of The Metropolitan Museum of Art. The initial investment may be as little as 5000. This portion of her.

The number of years from the date of gift 12152012 to the annuity starting date 112015 is 20464 years. Select the current federal income tax rate of the donor. You may deduct charitable contributions of money or property made to qualified organizations if you.

She has 2000000 to invest in the annuity. Tax deductions for charitable gift annuities depend on the number of beneficiaries and the age of the beneficiaries at the time. A charitable gift annuity enables you to transfer cash or marketable securities to the charitable organization issuing the gift annuity in exchange for a current income tax deduction and the.

How Taxes Deductions on Charitable Gift Annuities Work. Jones also desires to make a gift to her favorite charity. If you and your.

Unlike with a charitable remainder trust part of the gift may be used immediately by the charity with the remainder of the gift invested in an account to provide for the annuitants. At age 65 the rate is 47 and at age 70 it goes up to 51. If it is made at the end of the donors life it qualifies for an estate-tax charitable.

A charitable gift annuity is a contract between a donor and a charity with the following terms. 53808 105 5125. At her age she will receive payments fixed for life at 58.

As with any other lifetime. Mecklenburg North Carolina Charitable Gift Annuity. The interest factor suggested by the ACGA for 20464 years of deferral is.

If cash funds the gift annuity enter the same value as Value of Property. You can obtain these publications free of charge by calling 800-829-3676.

Turn Your Generosity Into Lifetime Income Los Angeles Jewish Health

What Is A Charitable Gift Annuity Thrivent

Abcs Of Cgas Basics Of Charitable Gift Annuities Gordon Fischer Law Firm

What Is A Charitable Gift Annuity Youtube

Cleveland Clinic Indian River Foundation Gifts That Pay You Income

Gifts That Provide Income Maine Organic Farmers And Gardeners

Gam What Is A Charitable Gift Annuity Pg Calc

Charitable Gift Annuity Rates January 2020 Alabama West Florida United Methodist Foundation

Life Income Gifts Giving To Reed Reed College

Charitable Gift Annuities Gospel For Asia

Charitable Gift Annuity Texas A M Foundation

Charitable Gift Annuity Tax Deductions Cga Rates Ren

9 Taxation Of Charitable Gift Annuities Part 1 Of 4 Planned Giving Design Center

Planned Giving 101 Charitable Gift Annuities Agfinancial

Key Differences Between Charitable Gift Annuities And Endowments Pnc Insights

Nyp Giving Planned Giving Gifts That Provide Income Charitable Gift Annuity Nyp